Financial uncertainty due to tensions between the US and the European Union over Greenland's possession impacts the precious metal and cryptocurrencies

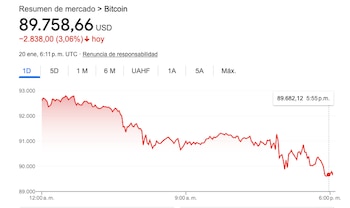

International financial uncertainty has once again pushed the price of gold to new all-time highs, while Bitcoin remains a highly vulnerable asset. The largest cryptocurrency fell 3% on Tuesday, dropping below $90,000, amid a decline in major stock market indices and growing investor risk aversion following its recent record highs.

Bitcoin adoption has advanced significantly in recent years, based on a more favorable regulatory environment for virtual currencies, but it remains an extremely volatile asset with fundamentals that are difficult for the market to establish. For this reason, it suffers from greater price instability than stocks and bonds.

Wall Street indexes fell within a significant range of 1.3% to 1.8%, while gold, the historically dominant safe-haven asset, climbed 3.8% to $4,770 an ounce, a nominal record high.

U.S. stocks posted sharp losses early Tuesday after President Donald Trump reignited trade war tensions with Europe over Greenland, while a global bond sell-off led by Japan reverberated through the markets.

Markets fell as investors fled riskier bets following a losing week for Wall Street stocks. Investors face a difficult return to trading as the risk of a full-blown trade war between the U.S. and the European Union stirs nervousness just as corporate earnings season begins.

Over the weekend, Trump declared that eight NATO countries would face additional 10% import tariffs unless the U.S. reached an agreement to purchase the Danish territory. On Monday, he intensified his efforts to seize Greenland, even as the EU negotiated $108 billion in retaliatory tariffs. He could also deploy an “anti-coercion instrument” with a potential loss of some $8 trillion for US assets.

On Monday, Trump threatened to impose a 200% tariff on French wine imports after French President Emmanuel Macron rejected the US president’s invitation to join his “Peace Board.”

The EU’s response to these threats will be “unrelenting, united, and proportionate,” European Commission President Ursula von der Leyen warned on Tuesday, keeping tensions high. Meanwhile, Greenland’s prime minister urged the population to prepare for a possible invasion.

Treasury yields hit four-month highs as a sell-off in Japanese bonds increased pressure on US debt. In other assets, the dollar (DXY) fell to a two-week low as the “Sell America” trend returned, and safe-haven investors pushed gold and silver to new record highs. Nvidia and Broadcom led to a sell-off in Big Tech stocks as investors abandoned AI-related shares, highlighting persistent concerns about a stock market bubble.

Attention now turns to the World Economic Forum in Davos, where Trump is reportedly meeting with other countries to discuss the Greenland crisis. He is scheduled to deliver his keynote address on Wednesday.

Bitcoin, the first virtual currency launched on the market, was created by Satoshi Nakamoto (a pseudonym) in 2008 following the global financial crisis. This digital currency was based on libertarian ideals and sought to challenge traditional monetary and financial institutions.

Known in the world of markets as BTC, Bitcoin uses cryptography to ensure its management is decentralized, meaning it cannot be regulated by any banking institution or body, which in turn makes cryptocurrencies volatile.

Despite the progress and reach of Bitcoin and other major digital assets like Ethereum, organizations such as the World Bank, the IMF (International Monetary Fund), and the IDB (Inter-American Development Bank) remain skeptical about the benefits of these types of cryptocurrencies.

Donald Trump's electoral victory represented a positive movement for the main cryptocurrencies on the market. At the end of 2024, Bitcoin reached a new all-time high, surpassing $107,000 per unit, after the US president reiterated his idea of creating a strategic reserve of the cryptocurrency.

.webp)

0 Comentarios